A mortgage is one of the biggest loans you’ll ever take out. So, it’s important to get a mortgage at a rate you can afford. There are a number of options available in the Republic of Ireland. The more you know about each rate before you start shopping around, the more the process will remain as smooth, seamless and stress-free as possible.*

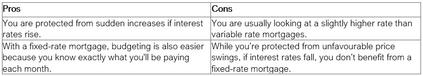

A fixed loan rate will stay the same for a pre-defined period of the mortgage, regardless of what happens to interest rates across the market. The period of the fixed rate will depend on the agreement between borrower and lender. You might see rates of “two-year fixed” or “five-year fixed” advertised, which simply refer to the length of time a set interest rate lasts. When the agreed fixed rate period comes to an end, the borrower moves to a standard variable rate unless they enter into a new fixed rate agreement with their lender.

If you wish to live in your home for a minimum of five years, a fixed-rate loan makes it easier to forecast your repayment costs.

The market has a number of variable rates available. Each type has its own features, so choosing the most suitable one for you depends on your budget and lifestyle.

1. Standard variable rates

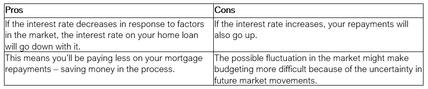

The standard variable rate (SVR) is the interest rate a mortgage lender usually will apply. It generally goes up or down as the ECB rates rise or fall, meaning your rate will move according to any changes in the ECB's base rate. (The ECB : European Central Bank, sets the key rates within the Euro area.)

2. Capped rates

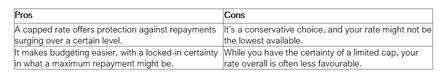

A capped rate refers to a limit set on how much the variable rate can increase for a predetermined amount of time. It can rise, but the cap cannot go above the set limit.

3. Discounted rates

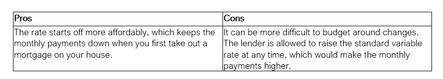

A discounted rate refers to a discount off the lender’s standard variable rate for an agreed amount of time. Usually, this discount is set to a short amount of time of the loan, between two and three years, after which the customer could switch over to a fixed or standard variable rate.

Top tip:

Look around when considering discounted rates. The standard variable rate might be higher if a larger discount is in place — meaning when the discount falls away you might be stuck with higher payments.

4. Loan-to-value rates

Also known as LTV rates, this rate is based on how much you owe on the mortgage in line with the value of the property you are buying.

For example, if you owe €150,000 on the property you are buying and it’s worth €200,000, your LTV would be 75%. Basically, this means you own 25% of your property and still owe 75% of the home’s value.

Lenders typically offer lower variable rates if you have a lower LTV rate, so the less you owe on your property, the better your rate can be.

Anything less than 50% is considered a low LTV and rates will be more favourable because the lender will be at less risk.

Top tip:

For this loan, it is always worthwhile reviewing the amount you owe along with your house's value to calculate your LTV — and doing this on a regular basis can save you money down the line.

5. Split rates

A split rate is when your mortgage is a combination between a fixed-rate and a variable rate.

With a split rate, part of your mortgage will be at a fixed rate — where the rate won’t change, and the other part will be at a variable rate — where the rate will shift with the market and bank’s movements.

Keep in mind: A split loan isn’t a separate loan. It requires splitting your home loan balance into two different accounts: one with the fixed-rate and one with the variable rate. For this, you’ll generally need to make separate repayments for each.

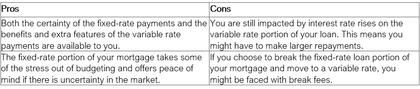

Not all lenders offer split rates. However, it’s worthwhile considering the combination of both. With split rates, you get the certainty that comes from a fixed rate and the benefits that might come from decreased payments at variable rates.

6. Tracker rates

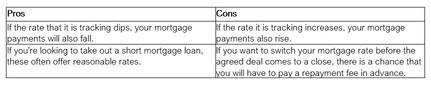

Tracker rates are linked to another interest rate, normally the ECB's base rate, so the mortgage rate would be the ECB rate plus a percentage. This means if the bank's base rate goes down, your rate will decrease by the same amount and if the ECB rate goes up, your mortgage rate rises accordingly.

To find out more about taking out a mortgage and the different steps of the home buying process, we've got a wealth of info for you. Visit our First-Time Buyers Hub to learn everything you need to make an informed decision about buying your first home.

*The information in this article is intended as a general guide and does not constitute formal legal or financial advice.