House hunting as a first-time buyer will certainly refine your nose for a bargain. You may even get to the point where you can correctly guess the value of a house before seeing the full listing. However, it’s the hidden costs that are harder to spot and also easy to overlook.

It's important to factor in for these costs from the very start to ensure that you're less likely to bust your budget because of unexpected fees.

There are a few mortgage origination fees that you’ll have to pay as soon as you apply for a mortgage.

Many lenders will ask for an application fee to cover the administrative costs involved in evaluating your request, like checking your credit history and processing paperwork. The cost will vary depending on the lender you choose to work with.

In addition to application fees, most lenders will charge a valuation fee. This covers a survey of the property that helps the lender to decide whether it is safe to lend on before approving a loan. The fee is usually fixed and will differ from lender to lender, but first-time buyers can expect it to be anything from €150 to €300.

The mortgage indemnity fee is designed to protect the lender in the event that you’re unable to repay the full value of your mortgage over the agreed period. If you’re borrowing more than 80% of the purchase price, you will need to pay 3% on the loan amount above the cut-off. So, your €300,000 home with a 90% mortgage will attract €1,050 in indemnity fees.

It’s also a good idea to pay a chartered surveyor to assess your home. Sellers aren't under any obligation to tell you about the defects a property might have. But a surveyor will be helpful in pointing out any issues with the home that might affect its value – or selling price. Fees vary from contractor to contractor, but you should expect to pay anything from €250 to €1,000 depending on the extent of the survey.

Finally, you are legally required to have mortgage protection insurance; this is to ensure that your mortgage will be paid off, should you or another policyholder pass away during the term of the mortgage. The exact cost of mortgage protection insurance is variable, so be sure to shop around to ensure you get the best deal possible.

Once your mortgage has been approved and you buy your home, you’ll need to pay a variety of fees and duties.

Besides the purchase amount, legal fees are easily the costliest part of buying a home. Most of these fees aren’t set and will vary depending on where you are and which solicitor you choose to use, although there are some rules that govern solicitors’ fees. Shop around and compare services to figure out what works best for you. And keep in mind that these fees usually exclude VAT.

This is charged for your initial meeting with a solicitor to outline the services you require and sign an agreement. Cost: approximately €250.

You will most likely be charged a flat rate plus a percentage of the value of the property above a defined amount to transfer ownership into your name. Cost: €1,000 + 1% of sale price.

The cost of checking whether there are any restrictions on your property (e.g. planning permissions or environmental matters). Cost: approximately €150.

Solicitors’ fees aren’t the only legal charges that come with purchasing a home. You will also have to pay to authenticate the sale and ownership documents, plus register the land in your name.

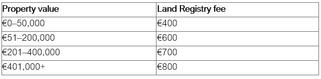

The standard Land Registry fee with a mortgage is €175. Plus there's an additional amount based on the value of your property:

You will also have to get a certified copy of the plans and paperwork from the Land Registry. In addition to that, the formal purchase of your home must legally be overseen by a commissioner of oaths. Both these documents come to around €84.

Whenever a property transfers ownership in Ireland, there's a tax to pay on the related documents. That tax is called Stamp Duty and it's one of the biggest hidden costs to be aware of.

The formula to calculate stamp duty is simple. You pay 1% up to a value of €1 million and 2% above that. One percent may not sound like a lot, but based on the average house price in Ireland of just over €290,000, you’ll need to set aside a minimum of €3,000.

Please note stamp duty is not covered by the mortgage, so you’ll have to pay it out of your own pocket.

As a home buyer, you will be liable to the Revenue for Local Property Tax (LPT). This is paid annually (by November 1 each year) on a self-assessment basis so you’ll have to calculate it yourself based on current market value, although rates are organised according to clearly defined bands.

A median-priced residential house in Ireland with a value of €285,000 would fall into band 3, meaning that an LPT of €315 would be due. Each local authority has the power to adjust its rate (up or down) by a maximum of 15%.

Most mortgage lenders will require you to have a policy that protects your home in the event of a fire, natural disaster, or another destructive event.

The premium of your insurance will depend on your risk profile as well as whether you insure your property for the replacement value (what it would cost to rebuild it from the ground up) or the market value (what it could be sold for).

Buildings insurance on a mid-sized home usually costs from €450 to €650 per year.

Once you've taken ownership of the property, it's time to turn that house into your home.

Keep in mind that you will likely need to do some renovation or decoration work when you move in. The cost of these projects will depend on the condition of your property and what you want to do with it.

As a rule of thumb, having an additional 10% of the value of your property set aside for renovating and decorating will ensure you’re covered.

Finally, you might want to calculate how much it will cost to relocate and move all your belongings from your current house to your new home. Moving can be costly and stressful – especially if you're moving to an entirely different town or suburb – so budgeting for this exercise will definitely take some pressure off of you.

If you wish to read more about the homebuying process, check out our first-time buyers hub here.