Glenveagh Properties plc ("Glenveagh" or the "Group") a leading Irish homebuilder announces its Final Results for the year ended 31 December 2020.

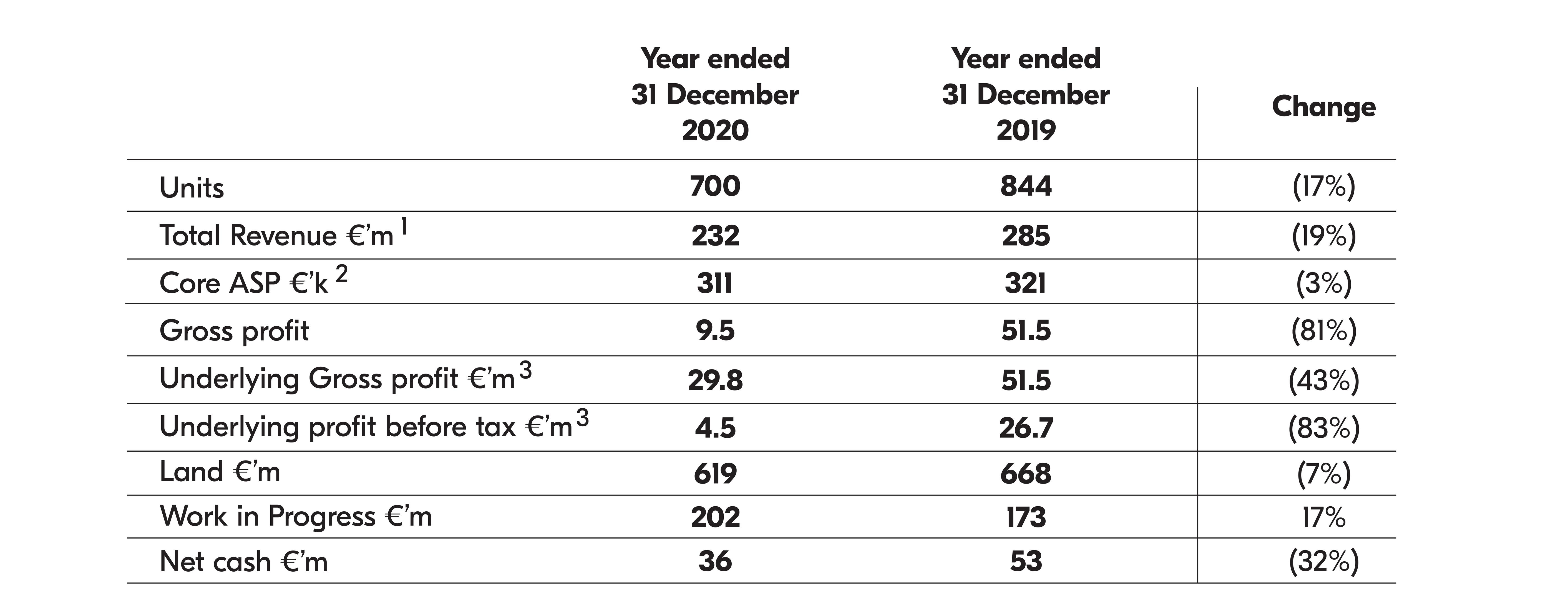

SUMMARY FINANCIALS

ATTRACTIVE CUSTOMER OFFERING DRIVING RESERVATIONS AND COMPLETIONS

· Customer leads +169% year-on-year in H2 2020

· Average weekly private reservation rate per site +31% year-on-year in H2 2020

· Strong forward sales with 9504 units currently sold, signed, or reserved (2020:475)

SECTOR LEADING CONSTRUCTION CAPABILITIES HIGHLIGHTED

· Strong delivery performance with 700-unit sales completed notwithstanding site closures due to Covid-19

· 1,150 completions expected for 20215 despite restrictions on construction due to Covid-19

· 23 cumulative site openings since IPO with a further six scheduled for 2021

RECOGNISED AS PARTNER OF CHOICE FOR INSTITUTIONS AND THE STATE

· Contracts exchanged with institutional purchaser for the sale of 132 units across two developments at Bray and Leixlip

· Contracts exchanged with Real I.S. for the sale of 134 units at Marina Village, with 65 completed to date

· Reservations in the year-to-date from Approved Housing Body ("AHB") for 85 cost rental units at two Suburban developments

DISCIPLINED CAPITAL MANAGEMENT AND GROUP REFINANCING

· Accelerated sales of non-core units and sites to facilitate a €100 million cash inflow within 12 months, resulting in a €20 million impairment

‒ €54 million of non-core proceeds received to date with a further €42 million currently contracted for 2021

· On track for €100 million plus reduction in land with €91 million achieved to date

· Targeted €202 million WIP investment underpins 1,1505 deliveries in 2021

· Robust operational delivery resulted in a net-cash position of €36 million (2019: €53 million)

‒ Current net cash remains broadly in line with year-end position despite restrictions on construction and selling activity

· Completion of five-year €250 million refinancing comprising a term component (€100 million) and a committed RCF (€150 million)

COMMITMENT TO SUSTAINABILITY

· Sustainability report published outlining the Group's efforts across our six sustainability pillars

· Emissions reduction initiatives and corresponding 25% Scope 1 and 2 intensity reduction target outlined

· Commitments, targets and measurable outcomes published across our sustainability landscape

OUTLOOK AND UPDATED GUIDANCE

In what is a challenging operating environment where the Group has yet to exit a second period of restrictions on housing delivery (with only social housing units progressing), our sector leading delivery capability has enabled the sale of 700 units in 2020 and allowed the Group to target 1,1505 units for 2021.

Demand for housing from our customers (private, institutional, and state agencies) continues to be strong and market fundamentals are in the Group's favour, more so now than in prior periods.

Management intends to present updated guidance to shareholders as part of our AGM on 27 May which will address the following: capital allocation; leverage policy; and medium-term ROE targets for the Group.

GLENVEAGH'S CHIEF EXECUTIVE STEPHEN GARVEY COMMENTED:

"The Group reacted quickly and effectively to the challenges of the Covid-19 pandemic, with the safety and wellbeing of our people, customers and local communities our priority. At the same time, we delivered a robust outcome for 2020, completing 700 units and are well-placed to deliver 1,150 units in 2021 despite restrictions on our construction operations.

I believe that the current challenges have broadened the long-term opportunity for the Group, with the fall-off in land transactions and commencement activity within the industry in 2020 a signal of the continuing gap between supply and demand. Our well capitalised platform which delivers across three business segments with access and affordability at the heart of our offering is best placed to help address this undersupply. And our ambition remains to scale the business to 3,000 units by 2024.

In, our first standalone Sustainability Report since we became a public company in 2017, we set out our approach to reducing Green House Gas ("GHG") emissions from our own operations and our supply chain, and the steps we are taking to reduce, re-use and recycle raw materials and resources.

We also explain the measures we are taking to keep our people and our contractors safe, to source responsibly, to attract, retain and inspire our people, to put customers at the heart of everything we do, and to create sustainable communities.

I would like to thank all our staff and industry partners who, despite the challenges faced, ensured we continued to operate safely and deliver for our customers and the communities in which we operate".

RESULTS PRESENTATION

A conference call for analysts and investors will take place at 8.30am this morning to present the financial and operational results followed by a Q&A session. Please pre-register at the link below to ensure your attendance is confirmed ahead of the commencement of the call:

· Click this link to register for the conference

Notes

1. Includes €24m of non-core revenues in each of 2019 and 2020

2. Change due largely to mix effects

3. Pre-asset impairment of €20.3 million in H1 2020

4. At 25 February, all scheduled for delivery in 2021

5. Including core and non-core. Assumes restrictions on residential construction end no later than 5 April