Glenveagh Properties PLC, a leading Irish homebuilder, is today issuing a trading update for the year ended 31 December 2021 ahead of the publication of its full year results on Tuesday, 1 March 2022.

Highlights

CEO STEPHEN GARVEY COMMENTED:

“Our business continues to perform strongly as we focus on scaling our operations and delivering high quality, sustainable homes in Ireland. By prioritising our people, customers, communities, and the environment we are well placed to achieve our ultimate target of over 3,000 homes each year.

Since we launched in 2017, we have proven that housing can be successfully delivered at scale in Ireland. We’ve pioneered the forward funding model in Ireland, led the industry in partnerships with local authorities, and transformed how land is acquired and used.

As we look to 2022 and beyond, the next key challenge for our business and the broader industry is the impact of on-site labour shortages. Our ongoing investment in supply chain integration positions us well in this regard. Having delivered over 700 units from our timber frame factory in 2021, we will continue to prioritise our off-site manufacturing capability to enable us to innovate how we build the homes of the future.

Taken together, this demonstrates the strength of our execution capabilities, business model and strategy.”

PERFORMANCE SUMMARY

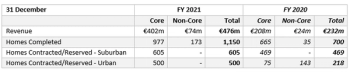

Total revenue for the year grew strongly to €476 million (2020: €232 million) driven by a 64% increase in the sale of new homes in the year.

The Company generated core revenue of €402 million, primarily from 977 unit sales, in-line with expectations. Core suburban ASP was €308k (2020: €311k) reflecting the Group’s continued focus on Suburban starter-home schemes.

Core gross margin in excess of 19.5% is in-line with previously communicated guidance and was driven by the recovery of Suburban margins due to the normalisation of operations in H2 as well as higher margins in the Urban segment arising primarily from the sale of the Castleforbes sites.

CPI remained a challenge for the sector in the second half of the year due to continued global supply chain constraints. As a result, the Group experienced 6% CPI in H2 marginally ahead of the 5% reported in H1 with this cost inflation being offset by similar HPI levels. The Irish housebuilding sector is experiencing an extraordinary point in time for cost and supply chain pressures and it is management’s expectation that the current challenging environment, including inflation, should ease over time.

To provide greater long-term control over costs, the business has focused on broadening its supply base, leveraging its central procurement capabilities and, having delivered over 700 units from our timber frame factory in 2021, enhancing our off-site manufacturing capabilities. The business is investing €16 million in additional timber frame and soil recovery facilities and will then have capacity to self-deliver over 2,000 off-site units in 2024.

SUBURBAN

Glenveagh delivered 902 core suburban units and finished the year with 605 suburban units contracted or reserved for 2022 (2020: 469) indicating strong demand, particularly from first-time buyers, and the maturing sales profile within the business. Strong demand is expected to persist due to favourable market conditions and the business is well positioned with all planning for the 1,400 suburban unit target for 2022 already in place.

The Group has acquired suburban land with the potential for 2,700 units in 2021, 75% of which has planning, at an aggregate cost of €72 million.

URBAN

In the year, the Group completed the sale of three individual urban developments:

In addition, Heads of terms have now been signed for two forward fund transactions of over 500 urban apartments for an aggregate Net Development Value of €185 million. These transactions will close in early 2022.

PARTNERSHIPS

During the year, the Group secured two landmark Partnership agreements for the proposed development of over 2,000 homes with Fingal County Council and Dublin City Council respectively.

Ballymastone

The first agreement, with Fingal County Council, is for the proposed development of 1,200 homes, including social, affordable, cost rental and private homes, at Ballymastone, Donabate in north County Dublin. A signed development agreement is now in place and a planning application will be submitted in 2022 with construction commencing immediately following planning being granted.

Oscar Traynor Road

The second agreement, with Dublin City Council, is for the proposed development of 853 social, affordable and cost rental homes at Oscar Traynor Road, Dublin. A planning application will be submitted in 2022 with construction commencing immediately following planning being granted.

These transactions and agreements further demonstrate Glenveagh’s ability to partner with government agencies and approved housing bodies to deliver social, affordable, cost-rental and private homes in attractive locations.

NON-CORE DISPOSALS

As outlined previously, the Group accelerated sales of the remaining non-core, high-end, private customer developments to maximise cash generation and allow the Company to maintain focus on its core business of starter homes. In 2021, the Group realised €74 million from non-core disposals as a result of the sale of 173 units in the Marina Village, Greystones, development.

CAPITAL ALLOCATION

The Group’s capital allocation priorities are to invest in supply chain, land, and work-in-progress. Once the business has invested sufficiently in each of these priorities, excess capital will be returned to shareholders. The Group continues to make good progress in this regard, having invested approximately €72 million in land opportunities for approximately 2,700 units in 2021, adding 2,000 units to our Partnership business, the addition of our second timber frame and soil recovery facilities and investing in work-in-progress through the opening of new sites.

As a result of strong operational delivery and our continued reduction of net investment in land, in-line withstated targets, Glenveagh ended the period with net cash of approximately €16 million.

Having met all of our capital allocation investment priorities, the Group returned €108 million to shareholders in 2021 in two separate share buyback programmes. An initial €75 million share buyback programme was announced on 28 May 2021, and this completed on 13 October 2021. A €100 million share buyback programme was announced on 16 November 2021 and is progressing well with €33m invested by year end. To facilitate this programme, approval of an additional authority to repurchase 10% of ordinary shares was approved by shareholders at an Extraordinary General Meeting which was held on 16 December 2021.

NON-EXECUTIVE DIRECTOR CHANGE

Glenveagh also announces today that Richard Cherry has informed the Board of his intention not to seek re-election at the 2022 AGM and he will step down from the Board with effect from the conclusion of the 2022 AGM.

The Company will announce revised Board committee composition in due course.

Glenveagh Chairman, John Mulcahy, commented:

"I would like to thank Richard for his invaluable contribution to the Board in the years following Glenveagh’s IPO, particularly in his role as Remuneration Committee Chair. The Board and the whole of Glenveagh are grateful to Richard for his dedication and service to the Company and we wish him all the best for the future."

OUTLOOK

The Group is targeting continued revenue and profit growth in 2022 which is underpinned by having all necessary sites operational, strong visibility on our supply chain and a good order book in place, while ensuring we continue to drive balance sheet efficiency to maximise value for shareholders. The market backdrop remains favourable with continued significant demand for housing, particularly starter homes, evident across the Group’s selling sites. Glenveagh will provide a further progress update on the current period to investors when we publish our full year results on Tuesday, 1 March 2022.