It’s been many months of saving for your mortgage deposit. You’ve spent plenty of weekends browsing online listings and visiting open houses. Now, you’ve finally found the property you want to call home. So, what’s next?

Before you’re able to collect your keys and start moving in, there are documents you’ll have to sign to make the sale legally binding.

Let's take a look at the contractual steps involved in buying a house; things that are good to know, especially for first-time buyers*.

Your mortgage lender will have a list of requirements that you need to meet when purchasing a home. These are usually related to proof of income and other assets. They also confirm how big of a deposit you’d need to borrow the full mortgage for which you’re eligible.

Once you’ve met all of your mortgage lender’s conditions, they will approve your loan for your home and will send you a formal letter of offer. This letter takes you one step closer to owning your first home. It contains all of the details about the mortgage that your lender will provide. These include:

When you find the place you want to call home, all you have to do is let your mortgage lender know. If you’ve met all of their requirements, they will send your letter of offer and other relevant paperwork to your solicitor.

Next, you need to arrange to meet with your solicitor to sign all of the documents sent by your mortgage lender.

There are a few steps involved when it comes to signing the documents that confirm the sale and purchase of a property.

Understanding the Terms

Once the mortgage lender has sent all of the legal paperwork through, you will need to meet with your solicitor. They will go through all of the documents with you, helping you to complete them and explaining anything you might not understand.

Signing the Contracts

When you’re happy that all the details are correct, you’ll sign the contracts in duplicate (i.e. two copies). Your solicitor will send both copies off to the seller’s solicitor for the seller to sign. This will ensure that both you and the seller have signed versions of the contract of sale once it’s concluded.

Paying the Deposit

You’ve made an offer to purchase and have legally agreed to buy the property. Now, you will need to pay your deposit over to the seller. Again, this is done through your solicitors. First, you transfer at least 10% of the value of the home to your solicitor. Then they pay it over to the seller through their solicitor.

Help to Buy Scheme

You may be entitled to avail of the government's Help to Buy Scheme, which is an incentive to help first-time buyers with the cost of a deposit on a new house or apartment. Find out more about the scheme here.

First Home Scheme

The First Home Scheme is a government shared equity scheme which can help first-time buyers. Find out more about the scheme here.

Completing the sale

When the seller has received and signed the contract – and collected your deposit – they will return one copy of the documentation to your solicitor. At this point, the seller has accepted your offer to purchase and agreed to sell you the property.

You and the seller will then settle on a completion date for the contract through your solicitors. This is the date and time by which the balance of the purchase price needs to be paid, and when you will get the keys to your new home.

Approval

Next, your solicitor must send all of the paperwork to your mortgage lender for approval. Once your lender is satisfied that everything is in order, they will send a mortgage cheque to your solicitor. Your solicitor will transfer the funds to the seller via their solicitor.

And just like that, you are officially the owner of your first home. Now you’ll move on to transferring the title of the property to your name and paying the various fees and taxes involved with that.

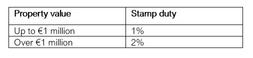

Whenever homes are bought and sold, the purchaser needs to pay stamp duty on the property. The rate of this tax is determined according to the value of the home you’re buying:

Stamp duty is charged on the written documents that transfer ownership of property. It pays the Revenue Commissioners for stamping the title deeds and will come due when you and the seller are signing the contract of sale.

Once you’ve signed the contracts and paid the stamp duty to your solicitor, you’ll move on to registering the property in your name.

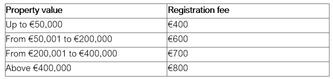

Now that your title deeds have been stamped by the Revenue Commissioners, you need to register them with either the Land Registry or Registry of Deeds.

The board you register with will depend on where the property was registered previously, but both systems are managed by the Property Registration Authority (PRA). Your solicitor will take care of this for you, but you’ll need to pay a fee to the PRA for the registration of deeds. The amount depends on the value of your property:

It’s good to note that even once your solicitor has completed the registration and paid the fee, the transfer of the property to your name at the deeds office can take months – or even years – to complete.

Every residential property in Ireland is subject to Local Property Tax (LPT). This tax is due on 1 November each year and if you purchase your home at around this time, you may have to pay some or all of the LPT.

The tax is based on the value of your property and is self-assessed, which means that you are responsible for working out and paying your LPT. The Revenue Commissioners provide guidance on how to work out the value of your property, how to file your property tax return and other LPT-related information.

Once all of the contracts of sale have been signed, sealed and delivered, and the relevant fees and taxes are paid, the house is yours.

When the closing date rolls around, you will meet with the estate agent you worked with to collect the keys and unlock the door to your future. Now all that’s left to do is to start making memories in your new home.

Find out everything you need to know about purchasing your first home, from saving for your mortgage deposit to how interest rates work.

*The information in this article is intended as a general guide and does not constitute formal legal or financial advice.