Buying a house is an important milestone in anyone's life and can be a very exciting time. It's also a big commitment that requires some financial planning.

How do you know if you can afford a house as a first-time buyer? How much can you borrow and what extra costs are there along the way? With so many things to consider, where do you begin?

Here's an overview of all the main costs involved in the homebuying process to help you make an informed decision about where you are in the home buying process and if there are a few more things left to tick off the list, before you become a home owner*.

First-time buyers can borrow up to four times their annual income for a mortgage. The lender does have some leeway to provide a larger loan; you can check the Central Bank's mortgage measures here, but for most first-time buyers the four times (4X) salary rule applies.

Remember that other loans (like the one you might have on your car) will also affect how much you can borrow for your home. Paying these down as quickly as possible can help you access a higher mortgage amount.

To get an estimate of the your total mortgage value and your monthly repayments factoring in the Government schemes that are available to first-time buyers, use the Glenveagh Mortgage Calculator. The calculator also takes into account different scheme thresholds in different local authority areas.

First-time buyers usually need to pay at least 10% of the purchase price of their property as a mortgage deposit. Lenders can also give you up to 5% more of the total property value if it will be your primary residence.

The way in which you secure your mortgage will also have an effect on the size of the loan you can get.

Mortgages provided by commercial lenders (like banks and lending agencies) will usually cover the full 90% of the value of your property if you follow the 4X rule.

In 2022 the government launched the First Home Scheme for the benefit of first-time buyers taking out a mortgage. Through this scheme, the state can pay up to 30% of the property price for an equivalent stake in the property. The criteria first-time buyers need to meet in order to avail of this scheme are as follows:

The Government has also renewed the Help to Buy scheme, which can be incredibly helpful for first-time buyers. Here’s how the scheme works, in a nutshell:

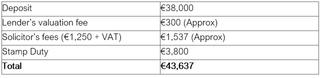

The main costs involved in buying a house are usually front and centre of every first-time buyer's mind. This is mainly because they account for the majority of the budget. However, there are some other costs to budget for as you prepare to buy your new home. These include consultation charges (such as a solicitor's fee), property taxes and stamp duty. Find out more about costs you need to take into consideration here.

The table below shows how much cash you would need on hand to purchase a €380,000 new property as a first-time buyer. Use it to help you figure out what you need to do to start saving for your dream home.

There are a few tried and trusted ways that you can save towards buying a house. For first-time buyers, using these tactics could see you holding the key to your new home in sooner.

These simple guidelines are the foundation for building the life you've always wanted in your new home.

*The information in this article is intended as a general guide and does not constitute formal legal or financial advice.