Glenveagh Properties plc ("Glenveagh" or the "Group") a leading Irish homebuilder announces its Final Results for the period ended 31 December 2022.

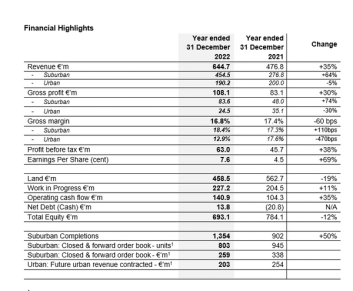

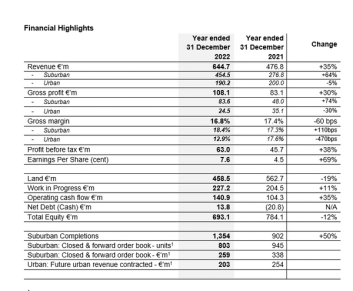

- Strong revenue growth in FY 2022 of 35% to €645m, driven by the Suburban business segment

- 1,354 suburban units closed, up 50% on the 902 units closed in FY 2021 and 90% ahead of the 712 suburban units closed in FY 2019

- Urban transactions completed during the year are expected to generate overall revenue of over €310 million. Urban assets now comprise approximately 13% of the Group’s total landbank

- Advanced the Partnerships segment with planning submitted for both Oscar Traynor Road and Ballymastone in H2 2022. An initial planning decision in favour of both applications has been made and these are currently subject to any ongoing appeals

- Overall gross margin of 16.8% (FY 2021: 17.4%)

- Suburban gross margin improved to 18.4% (FY 2021: 17.3%)

- Urban gross margin was 12.9% in FY 2022 (FY 2021: 17.6%)

- Mitigated the impact of build cost inflation to a 8%-9% level through effective use of the Group’s scale and long-term supply chain commitments

- EPS consistent with Group guidance at 7.6 cents, representing growth of 69% year on year

- Advanced the Group’s off-site manufacturing strategy through the acquisition of Harmony Timber Solution Ltd. (“Harmony”) and the establishment of our light gauge steel (“LGS”) manufacturing partnership

- Continued to improve the capital efficiency of the Group’s land investment, with landbank value at year end of €458.5 million (FY21: €562.7 million)

- Continued financial discipline evident with modest net debt at year end of €13.8 million

- Further progress on our capital efficiency strategy, with the business returning approximately €150 million to shareholders in the year, bringing the overall returns over a two-year period to over €250 million

- Strong progress made to further integrate sustainability throughout the business, including the launch of its Equity, Diversity & Inclusion (“EDI”) strategy in December 2022

Outlook

- The Group continues to see a very positive long-term outlook for the Irish residential housing market and we believe we are well positioned to take advantage of that opportunity. We are now active on 21 suburban and urban construction sites, with an additional five new sites to open during this year for first deliveries in FY 2024

- We continue to anticipate that suburban unit deliveries for FY 2023 will be broadly in line with FY 2022 levels. Further improvement in the suburban margin is expected in FY 2023 to approximately 19%, and given strong underlying demand we anticipate an EPS outturn for FY 2023 of 7.5–8.0 cents

- We are actively managing suburban unit reservations for FY 2023 and closed units and reservations for this year now stand at 803 units, supported by strong underlying market demand and by the updated Housing for All initiatives and the change to the Central Bank of Ireland's macroprudential rules that both became effective in January 2023

- The Group has seen some progress in planning momentum since the start of the year and it is anticipated that additional resources will be provided to the planning board in the coming months to improve its processing capability. Given positive recent momentum in the Large-Scale Residential Development (“LRD”) planning process, we anticipate final planning decisions on Ballymastone by Q2 2023 and on Oscar Traynor Road by Q3 2023, both in our Partnerships business segment. The segment remains on track for revenue and profits generation in FY 2024

- In FY 2023 we anticipate making further efficiencies in our land investment, while WIP is expected to increase to reflect ongoing urban developments. As such net debt is expected to reach 10-15% of net assets by the end of FY 2023, that will then unwind during FY 2024 as these urban developments are completed

- The Group agreed a new €350m five-year sustainability linked finance facility in February 2023, extending the tenure of facilities by two years and expanding available facilities by €100 million

- The Group also today launched its Net Zero transition plan that sets both near-term GHG emissions reduction targets and long-term net zero GHG emissions targets for Scopes 1, 2 and 3, in line with guidance from the Science Based Targets initiative (SBTi)

- Our current share buyback programme, initiated on 6 January 2023, progresses to plan and approximately €30m has been returned to shareholders to date, in line with our capital allocation framework

- With a very healthy land portfolio and the resources and capability in place to drive operational expansion, the Group continues to have strong confidence in its capacity to achieve its 2,000 suburban unit target, as well as the continued delivery of urban projects and generating its first revenue from its Partnerships business, for FY 2024

- Our unwavering focus on capital efficiency and cash generation places the business in an excellent position to deliver long-term operational growth and to maximise returns for shareholders, with our Return on Equity target of 15% in 2024 continuing to be our key capital metric

CEO Stephen Garvey commented:

“We are in a very strong position to continue scaling our business, enhancing our profitability and delivering even more of the high-quality, sustainable, affordable homes that Ireland urgently needs.

We made excellent progress in 2022 in driving strong growth in our key suburban business, strengthening our partnerships business and de-risking our urban land portfolio.

We have also demonstrated rigorous control of our costs, significant innovation in acquisitions to enhance our supply chain, and an optimised capital management programme that has returned over €250 million to shareholders in two years.

But the fact remains that we are capable of building many more new homes if the Government matches its ambitions on much-needed planning reform with the decisive and meaningful action that Ireland’s accommodation crisis warrants. It deserves credit for the effectiveness of its measures supporting first-time buyers, but this crisis cannot be ended without a significant ramp-up in supply across the industry.

We are ready to play a leading role in delivering more supply; our own experience already this year is proving that even in a more economically challenged environment there is still significant demand for the right product. But the industry needs correct policy decisions and a planning framework that is designed for the types of homes that people want - and one which does not undermine the commercial viability of delivering more of these types of homes.”