Glenveagh Properties plc ("Glenveagh" or the "Group") a leading Irish homebuilder announces its Final Results for the period ended 31 December 2023.

FY 2023 Performance

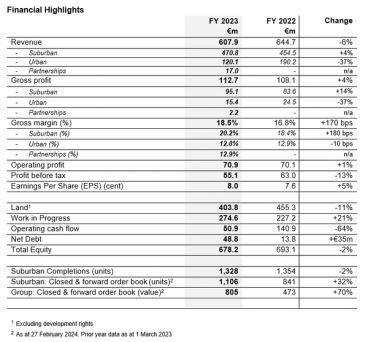

- In FY 2023 we increased suburban revenue and margin, our Partnerships business segment started to generate revenue and profits, and we benefitted from strong planning momentum

- We delivered EPS of 8.0 cent, a 5.3% advance in the year and at the top end of our guided range

- During FY 2023 we were granted permissions for approximately 4,600 units, approximately 400 of which are currently in post-grant appeal periods. We also lodged planning applications for approximately 2,900 units

- Standardisation played an increasingly significant part in our momentum, driving greater efficiencies at every part of our value chain and incorporating standardised house types into the manufacturing and delivery process, while enhancing build quality and customer service. We more than doubled the number of standardised housing types we supplied, and this year only a small percentage of homes will be non-standardised. As a result, we can plan, design, and build houses more effectively, with greater efficiency and speed, and in greater numbers than ever before

- We launched NUA as our off-site manufacturing business with the capacity to deliver product for over 2,000 homes from three strategically located sites. NUA gives us greater control over our supply chain, allows for faster, more consistent construction in a sustainable manner, and enables us to get products to market faster. We are committed to embedding innovation and modern methods of construction into our product offering, and ongoing projects are focused on enhancing the premanufactured value of these products and also on driving further operational efficiencies in our manufacturing processes

- We also progressed with our sustainability agenda, launching our Net Zero transition plan in March 2023. This is an important milestone for our investors and customers as the focus increases on energy efficiency. Our Scope 3 emissions have now decreased by 7% against our 2021 baseline, measured on an intensity basis (tCO2e/100sqm). In early 2024 we also published both our Biodiversity and Circular Economy strategies and have had our science-based targets (SBTs) verified by the Science Based Targets initiative (SBTi)

- Net Debt was maintained at prudent levels as we continued to generate efficiencies from our landbank while also investing in our work-in-progress (‘WIP’) for FY 2024 and completing our significant investment in NUA

- We also returned approximately €63 million to shareholders, bringing the overall returns over a three-year period to over €300 million

Outlook

- The long-term demand outlook for the Irish residential housing market remains very positive. A resilient domestic economy is coupled with a fast-growing population and reinforced by supportive State initiatives. Our proven operational capability and established expertise in partnership and urban development models mean that we are ideally positioned to grow as a scale operator in the Irish market

- We are actively working with the multiple state agencies that the Government is using to stimulate and accelerate housing supply. We are transacting with approved housing bodies and local authorities to supply increasing numbers of cost rental, social and affordable housing through this year and next. We are engaging closely with the Land Development Agency (‘LDA’) on projects that can potentially activate our urban portfolio, with additional opportunities possible over time to partner on projects on State land. We also have a project approved in the Croí Cónaithe scheme. We will direct resources and investment as appropriate as these partnering opportunities materialise

- We expect to generate strong revenue and profit growth across each of our Suburban, Urban and Partnerships business segments in FY 2024. This growth is underpinned by our healthy land portfolio and forward order book, continued planning momentum and strong operational and manufacturing capability

- The further advance in our forward suburban order book for FY 2024 of 1,106 units closed or contracted gives us increased confidence on the outlook for our Suburban business segment. A further improvement in the underlying suburban margin is expected in FY 2024

- Urban revenue is expected to comprise contributions from projects already contracted as well as from new revenue opportunities. Construction of our Croí Cónaithe development in Cork will begin in mid-year

- We anticipate that revenue from our Partnerships segment will exceed €100 million in FY 2024, with a gross margin of approximately 15%. We expect to commence the construction of almost 1,300 homes under our partnership schemes this year

- In FY 2024 we anticipate making further efficiencies in our land investment, while WIP is expected to increase modestly as the unwinding of current urban developments is more than offset by increased suburban activity and new urban investment. Net debt is expected to be approximately 10-15% of net assets at the end of FY 2024

- Our focus remains on enhancing the capital efficiency of the business and increasing cash generation. Once our capital allocation priorities are satisfied, we remain committed to returning any excess cash identified to shareholders

- Our stronger forward order book, operational momentum, and continued progress in manufacturing means that we have increased confidence with current consensus EPS expectations for FY 2024 of approximately 17 cent

CEO Stephen Garvey commented:

“We achieved our objectives in 2023 and this sets us up very well to operate at scale in 2024 and beyond.

Our business is performing effectively, delivering at pace and at scale the new homes that Irish people badly need – energy-efficient and high-quality homes designed for value and affordability, that work well with government initiatives. In 2024 we will see families, couples and individuals move into over 2,700 new homes that we have delivered.

Our greater scale is underpinned by the increased control we have taken over our supply chain in recent years. We are already seeing the benefits of investing in our NUA manufacturing business, to give us significant advantages in off-site manufacturing, innovative design, more sustainable processes, standardisation of our product range and greater efficiency and cost management.

NUA has also allowed us to develop a clear leadership position in modern methods of construction in the Irish market.

We are operating in a more favourable planning environment that is unrecognisable from two years ago. However, while the planning system is catching up with the backlog successfully, prospective homebuyers need to see ongoing investment by the State in additional planning and infrastructure resources to prevent a recurrence of backlogs, as output levels across the housebuilding industry continue to rise sharply to meet the supply shortage.

Notwithstanding this we remain confident about the outlook, not least because the State has cemented its position as a key driver of boosting supply and ultimately meeting the high level of demand that remains evident. We are engaging with the State across multiple initiatives that are working and making a real difference – our Partnerships business is delivering thousands of new homes in conjunction with local authorities and approved housing bodies; homebuyers are benefiting from Help to Buy and the First Home Scheme; and we are seeing significant scope for the LDA and other initiatives to accelerate supply.”