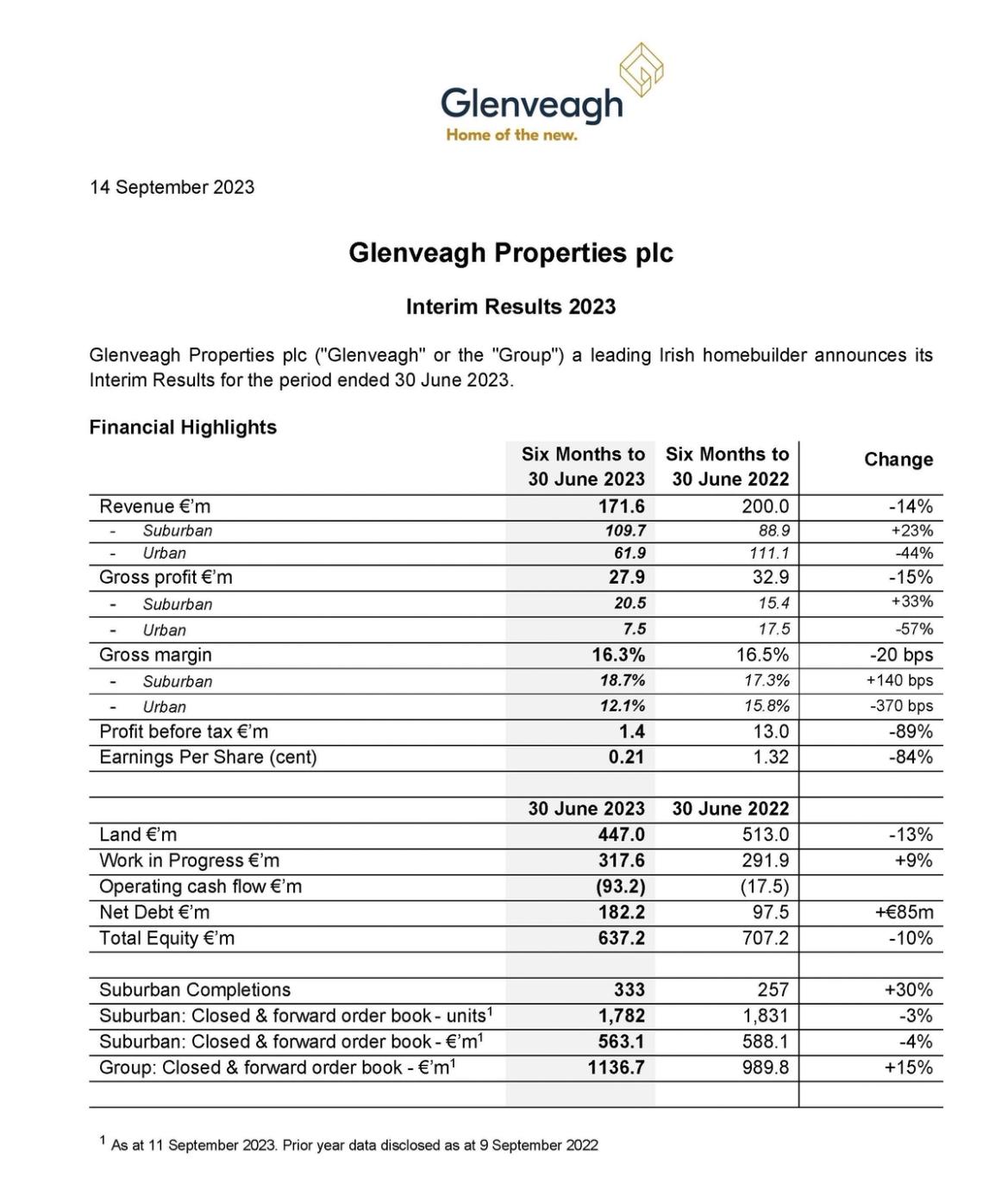

Glenveagh Properties plc ("Glenveagh" or the "Group") a leading Irish homebuilder announces its Interim Results for the period ended 30 June 2023.

Trading Summary

- We reiterate our FY 2023 guidance, anticipating an EPS outturn of 7.5-8.0 cents

- The Group performed to expectation in H1 2023 and increased suburban margin, secured approvals for both of its Partnerships sites, and benefitted from strong planning momentum. Profitability was impacted primarily by lower urban revenues, reflecting a higher H1 2022 comparative that included approximately €63m from the disposal of the East Road site, along with increased financing costs

- The Group has been granted permissions for approximately 4,000 units so far this year, some 700 of which are currently in post-grant appeal periods

- Our strategy of supply chain integration, combined with our scale and long-term supply chain commitments, enabled us to mitigate build cost inflation to a 4-5% level in H1 2023

- In June we launched NUA, the innovative manufacturing and new technology arm of the Group. NUA will lead innovation in modern methods of construction in the Irish market. Significant investment here is now largely completed and the business will have the capacity to deliver over 2,000 units in FY 2024 from our three off-site manufacturing facilities in Carlow, Arklow, and Dundalk.

- Our share buyback programme, initiated on 6 January 2023, was completed on 2 August 2023. Approximately €63 million was returned to shareholders, bringing overall returns to over €300 million since May 2021

- Strong progress was also made to further integrate sustainability throughout the business, alongside the launch of our Net Zero transition plan in March 2023

- All suburban units capable of closing in FY 2023 are now sold, signed or reserved. Further improvement in the suburban margin is expected in FY 2023 to approximately 19%

- Approximately €120m of revenue will be recognised in FY 2023 from the Group’s Urban business segment

- We anticipate making further efficiencies in our land investment and expect land value to approach €400 million by 31 December 2023, with further efficiencies anticipated in FY 2024. Work in progress (WIP) at year end is expected to increase on FY 2022 levels, to reflect ongoing developments in our urban portfolio. Net debt is expected to reach 10-15% of net assets at year end

Outlook

- We continue to see a very positive long-term demand outlook for the Irish residential housing market. Strong private demand is underpinned by a robust economic environment, a fast-growing population and supportive demand-side initiatives from the Government

- New opportunities are emerging to partner with multiple State agencies as part of the Government’s recent supply-side housing initiatives. Significant additional funding has been proposed for the Land Development Agency (LDA). In addition, one of our urban schemes of over 250 units has been approved under the Croi Conaithe programme and this is expected to commence in Q4. Our scale, operational capability and established expertise in partnership and urban development models, leaves us ideally positioned to participate in such initiatives. These have the potential to generate significant incremental revenue and profits for the Group over the medium term

- The improved planning momentum means that the Group has planning permission for all of its expected deliveries in FY 2024. Based on planning lodgements year to date and anticipated in the rest of this year, over 70% of our current landbank will be fully planned and available for development by the end of FY 2024

- We are currently active on 24 suburban and urban sites, including all of our large suburban sites required for FY 2024 delivery

- In our Partnerships business segment, enabling works have now commenced on both our Ballymastone and Oscar Traynor Road sites and we expect to deliver revenue of over €100 million in FY 2024, with an anticipated gross margin of approximately 15%

- A very healthy land portfolio and forward order book, combined with strong planning momentum and robust operational and manufacturing capability, gives the Group increasing confidence in its capacity to generate strong revenue and profit growth across its Suburban, Urban and Partnerships business segments in FY 2024. We are comfortable with current consensus EPS expectations for FY 2024 of approximately 17 cents

- We continue to remain focused on enhancing capital efficiency and cash generation across the business, with a renewed focus on investment in urban development activity in particular. Once our capital allocation priorities are satisfied, we will continue to return any excess cash identified to shareholders. This will underpin the delivery of long-term operational growth and optimal returns for shareholders, with our Return on Equity target of 15% in 2024 our key capital metric

CEO Stephen Garvey commented:

“We began the year with three clear objectives – to grow our portfolio of planned sites, to advance our Partnerships business, and to transform our manufacturing business.

While planning delays proved challenging at the start to the year, we have seen a strong upturn in permissions granted through 2023 and are on track to have over 70% of our current landbank fully planned and available by the end of FY 2024.

We began 2023 with no planning achieved in our Partnerships segment, to now being commenced on two of the largest such sites in the country. We are proving that public and private entities can work successfully together to deliver sustainable mixed tenure developments.

Partnerships are how substantial housing volume can be delivered effectively across all tenures. I encourage the Government to focus on this area as a vehicle to address the housing crisis.

The continued reform of planning policy and system, as well as the Government’s demand and supply side initiatives, are showing positive results too.

NUA is now at scale to deliver in 2024. This business gives us an excellent platform for delivering greater volumes of sustainable, high-quality, energy-efficient new homes using modern methods of construction.

The outlook across Glenveagh’s businesses is favourable and the opportunities are compelling. We are ideally placed to serve what continues to be strong private demand, in addition to working constructively with State agencies on supply-side initiatives. Accelerating the provision of new housing is critical to help sustain economic strength and to accommodate our young and fast-growing population.”