Full year expectations reiterated for a milestone year of growth

Announcing intention to commence €50 million share buyback programme

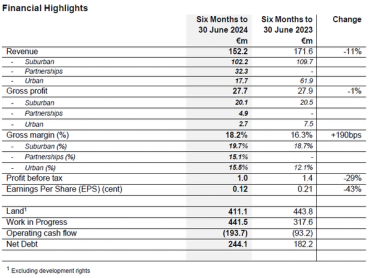

Glenveagh Properties plc ("Glenveagh" or the "Group") a leading Irish homebuilder announces its Interim Results for the period ended 30 June 2024.

Operational Highlights

- Closed and forward order book totalling approximately €1.4 billion across our three business segments, underpinning our 2,700 completions for FY 2024 and giving strong visibility on deliveries and revenue into FY 2025

- Over 800 units of the 2,700 full year target completed in H1 2024 (H1 2023: 333)

- Suburban completions of 294 units in the first half (H1 2023: 333) have accelerated strongly in the third quarter. The closed and forward order book in the Suburban business is €770 million, comprising 2,215 units for delivery in FY 2024 and early FY 2025. Driven by our enlarged scale, increased standardisation of product and processes, and continued integration of manufacturing, Suburban gross margin is expected to be in excess of 20% in FY 2024, compared to an underlying margin of 19.3% in FY 2023

- Partnerships performance reflected increased construction activity in our Balmoston (Ballymastone) and Oscar Traynor Road sites. A third Partnerships contract for a site adjacent to Balmoston is now completed, with site development works now commenced. We are also advancing a fourth agreement and combined, these agreements will add approximately 1,000 units to our Partnerships pipeline for delivery from FY 2025 onwards

- Urban performance reflected the completion of 510 units from existing forward fund transactions, where approximately 90% of revenue has already been recognised in prior periods. Following the request to join the Land Development Agency (“LDA”) framework panel to accelerate the delivery of mixed tenure homes, a partnership with the agency to commence the activation of our Urban portfolio in Cork Docklands, via a forward fund transaction, is subject to final legal agreement

- Strong planning momentum with permissions now granted for approximately 1,500 units so far this year with over 95% of units targeted for FY 2025 now with planning permissions granted

- Good progress with our sustainability ambitions, focussing on implementing actions in line with our strategies on Net Zero transition, biodiversity and circular economy Disciplined Capital Allocation Supporting Growth and Returns

- As noted in our H1 Trading Statement on 4 July, we see potential to accelerate our future land investment plans and significantly expand our landbank in the near term in highly attractive locations. These investments, should they all materialise, would provide more than 6,000 units across multiple tenures, with an attractive return profile. These acquisitions would also provide potential to secure partnership agreements on adjacent sites for approximately 2,000 units, further enhancing the growth and return potential for that business segment and the Group overall

- Assuming these acquisitions are completed, our landbank value at year end would be approximately €500 million, with our medium-term target remaining at less than €400 million

- We remain committed to returning excess cash identified to shareholders, in accordance with our capital allocation framework. Given our operational and financial position and our confidence in the future cash generation and balance sheet strength of the business, we are pleased to announce the intention to commence on 6 September 2024 a €50 million share buyback programme, having returned over €300 million of capital to shareholders since the beginning of FY 2021

- Net Debt is expected to fall to below €200m by the end of FY 2024. This includes the commencement of our share buyback programme and all anticipated land acquisitions, should they materialise, and is within our guidance range of 15-25% of gross assets, a measure that now aligns with current covenant metrics

Outlook

- FY 2024 is a milestone year of growth for Glenveagh. We operate in a thriving market with strong demand, driven by an outperforming economy, strong population growth, and supportive State initiatives

- Our ability to deliver great value, high-quality, sustainable homes at scale via our proven vertically integrated operation positions the business at the forefront of meeting Ireland’s housing needs into the future

- We reiterate our full year EPS guidance which anticipates a more than doubling of EPS to approximately 17 cent in FY 2024 and a Return on Equity target of approximately 15%

CFO Transition

- Glenveagh today announces that Michael Rice has informed the Board that he is stepping down from his role as Executive Director and Chief Financial Officer (“CFO”) of Glenveagh to pursue other interests. Michael will step down from the Board on 31 December 2024 but will remain with Glenveagh into 2025 to ensure a smooth transition. Michael will be succeeded in the role of CFO by Conor Murtagh, who is currently Chief Strategy Officer and a member of the Group’s Executive Committee.

CEO Stephen Garvey commented:

“Our report today strongly signals that our business remains on a solid trajectory in 2024, achieving significant milestones across all three business segments.

Our ability to consistently deliver high-quality, sustainable homes at scale reflects the strength of our vertically integrated operation and the skill and dedication of our team at Glenveagh. We are on track to deliver on our target of 2,700 homes this year, a critical objective in our role in the sector responding to Ireland’s housing needs.

Glenveagh’s pioneering of modern methods of construction and our focus on standardisation and innovation are central to our strategy. As we continue to expand, our commitment to sustainability, efficiency, and affordability remains at the core of our operations.

We welcome the Government’s ongoing commitment to driving housing completions forward through targeted initiatives that enhance viability, and improvements in the planning system. The momentum we've seen in new home commencements and the growing output across the industry are promising indicators that Ireland can achieve the necessary increase in housing supply. Yet, as we aim to scale our activities further, collaboration between the public and private sectors remains key. It is crucial that we build upon the foundations laid by current initiatives to reach the next phase of output growth delivering over 50,000 units per annum.

We are confident that with continued targeted policy measures and strategic partnerships involving both capital and land between the public and private sectors, we will not only meet but exceed the housing targets necessary to respond to the housing needs of Ireland’s growing population and to bolster and sustain ongoing economic successes.”

Read the statement in full here.