Glenveagh delivers 2025 EPS ahead of guidance

Strong landbank and efficient delivery platform underpin 2026 outlook

Glenveagh delivered a strong performance in 2025, reflecting continued momentum across both the Homebuilding and Partnerships business segments, and the benefits of scale, standardisation and vertically integrated manufacturing which continue to enhance build quality and value for money for customers.

The Group made further progress against its strategic priorities, increasing output, improving returns and strengthening visibility into future delivery, while continuing to optimise capital employed across the business.

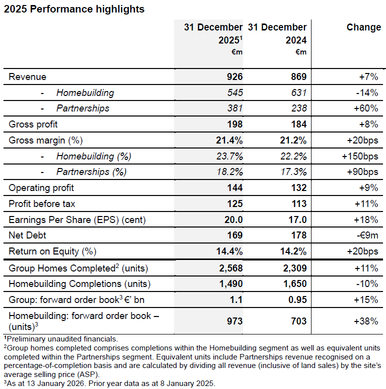

Group completions increased to 2,568 units (2024: 2,309), reflecting strong execution across both Homebuilding and Partnerships.

Homebuilding delivered 1,490 (2024: 1,650) units at a gross margin of 23.7% (2024: 22.2%), reflecting the benefits of standardisation, scale and vertical integration, supported by favourable site mix and disciplined execution of the Group’s land sales strategy.

Partnerships delivered revenue of €381 million (2024: €238 million), driven by strong progress across all projects, firmly establishing the segment as a core delivery channel and Glenveagh as an established partner of choice for the State.

Expansion of gross margin in both Homebuilding +150bps and Partnerships +90bps ensured Group gross margin expanded to approximately 21.4% (2024: 21.2%), despite divisional mix effects.

In H2 the Group secured an additional Partnership mandate subject to planning on State-owned land (approximately 350 units) and entered advanced discussions on three further Partnerships opportunities across Glenveagh-controlled sites totalling approximately 400 units.

Planning lodgements in the period totalled approximately 5,000 units. All units delivering in 2026 have commenced, and all units for 2027 are now planned or have active planning applications, supporting future growth and delivery.

The Group delivered EPS of approximately 20.0 cent in 2025 (2024: 17.0 cent), ahead of guidance, underpinned by solid delivery execution, disciplined cost control and a consistent approach to capital allocation.

Land disposals totalled €55 million in 2025 (2024: €23 million), with a further pipeline of transactions contracted or under negotiation, leaving the Group on track to deliver €100 million of land sales across 2025 and 2026. This activity is aligned with the Group’s disciplined capital allocation framework and delivery strategy, with a focus on ROCE and sites of scale.

Net debt declined to approximately €169 million at year end (H1 2025: €230 million), despite higher production levels, reflecting healthy cash generation in H2 and prudent capital deployment.

Successful completion of €105 million share buyback programme and commencement today of a further €25 million share buyback programme bringing the total capital returned to shareholders to approximately €445 million since 2021.

Outlook for 2026

For 2026, the Group is guiding EPS of up to 21 cent, reflecting continued growth in completions, the ongoing contribution from Partnerships and disciplined cost control.

The Group enters 2026 with positive operational and financial momentum, underpinned by a high-quality landbank, a scaled and capital efficient Partnerships segment, an efficient delivery platform and continued, encouraging demand for housing across all tenures.

The fundamentals of the Irish residential housing market remain supportive, reflected in the Group’s forward order book of approximately €1.1 billion (2024: €0.95 billion), providing clear visibility into future delivery.

Total Group completions in 2026 are expected to be approximately 2,750 units, comprising over 1,600 Homebuilding units, alongside further growth in the Partnerships segment with the Group’s identified Partnerships pipeline underpinning an average annual gross profit contribution of at least €60 million for the Partnerships business.

Looking further ahead, the Group now expects to scale Homebuilding output to approximately 2,000 units by 2027 (previously 1,900), supported by planning visibility, standardisation, and the benefits of its vertically integrated manufacturing capability. This growth trajectory, combined with a capital-efficient Partnerships model and active landbank optimisation, positions the Group to continue to deliver sustainable earnings growth and attractive returns over the medium term.

Capital allocation

Since 2021 the Group has returned approximately €420 million to shareholders through a series of share buybacks at an average price of €1.16, resulting in an approximately 40% reduction in shares outstanding.

In line with its capital allocation priorities and supported by strong operational performance, cash flow generation, and visibility on further land sales, the Group is pleased to announce the intention to commence a further €25 million share buyback programme on 15 January 2026.

The programme is expected to run until the Group’s AGM in May. Furthermore, the Group expects to be highly cash generative in the second half of 2026, which combined with planned land sales, is expected to support continued returns to shareholders.

CEO Stephen Garvey commented:

“In 2025, Glenveagh delivered on its commitments: scaling delivery and strengthening our Partnerships platform through our standardised, vertically integrated model. Our landbank, manufacturing capability and customer-first approach continue to differentiate us in a market that urgently needs scale, certainty and delivery. Our focus remains on driving sustainable growth, leveraging efficiencies across our integrated supply chain, investing in innovative precision manufacturing and design skills, and expanding our execution capability to capture long-term value for stakeholders.

The Government has demonstrated a clear commitment to creating a supportive policy environment for increasing housing supply across multiple tenures. This is evidenced by the revised National Planning Framework, the introduction of updated apartment standards and the reduction in VAT on apartment construction, alongside continued investment in housing-related infrastructure through the National Development Plan.

The policy framework to support increased housing delivery is now largely in place. The priority must therefore shift to consistent and timely implementation, and alignment of standards, across all arms of the State, including local authorities, utilities and infrastructure agencies. Clear, coordinated execution (particularly in relation to zoning, servicing and infrastructure delivery) will be critical to removing remaining structural barriers and enabling housing supply at scale.

Encouragingly, recent progress on major enabling infrastructure, including approvals relating to Greater Dublin Drainage and Metro projects, demonstrates that coordinated action can materially improve the viability and timing of projects of national importance, providing greater certainty for delivery.

Ireland is at a pivotal moment in addressing its housing needs and supporting long-term economic competitiveness. Glenveagh has the land, capability and capital to deliver high-quality homes at scale, and we are ready to play a leading role.”

Divisional commentary

Homebuilding

The Homebuilding segment generated revenue of approximately €545 million (2024: €631 million), delivering 1,490 completions (2024: 1,650), in line with guidance. Average Selling Price (ASP) reduced as expected to €347k (2024: €365k), reflective of site and product mix.

Homebuilding margin improved to 23.7% in 2025 (2024: 22.2%), ahead of expectations, underpinned by Glenveagh’s focus on standardisation, scale and vertical integration, and further supported by land sales (approximately +120bps).

Operationally, the segment benefited from substantial completions at Kilmartin Grove, Hollystown, which has now delivered more than 800 units across 2024 and 2025, and the successful completion of Hereford Park, Leixlip, which commenced in 2024 and represented 235 units. Construction progressed at new sites, Rath Rua in Portlaoise and Greville Park in Mullingar. Recently acquired sites at Oldtown and Mooretown are advancing, supporting future delivery and reinforcing the Group’s scalable growth strategy.

The Group finished the year with 973 Homebuilding units contracted or reserved (2024: 703), reflecting continued demand for our high-quality homes and enduring strength of our strategically assembled landbank.

Homebuilding gross margin in 2026 is expected to be above 21%, with land sales anticipated to continue to provide a supportive tailwind. The Group’s Homebuilding intake margin is approximately 21%. Planning permissions are now secured for all targeted output in 2026, and all remaining applications for 2027 are lodged and working their way through the system in line with expectations.

Partnerships

The Partnerships segment continued to scale in 2025, with revenue increasing by 60% to €381 million (2024: €238 million), driven by strong progress across multiple large-scale projects.

Partnerships gross margin in 2025 was 18.2% (2024: 17.3%). This reflected effective execution on sites completed during the year, the availability of unutilised contingency, and a positive contribution from land sales (approximately +190bps).

Excluding the impact of land sales, the underlying Partnerships margin was approximately 16.3%, ahead of expectations for the margin potential of the segment.

In H2 2025, the Group secured an additional Partnerships award subject to planning on state-owned land (approximately 350 units) and entered advanced discussions on three further Partnerships opportunities across Glenveagh-controlled sites totalling approximately 400 units.