Glenveagh Properties plc (“Glenveagh” or the “Group”) announces its Interim Results for the six months ended 30 June 2025.

Financial Highlights

H1 2025 Summary Performance

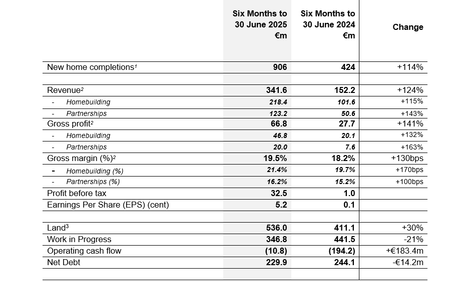

- More than 900 units1 completed in H1 2025 (H1 2024: 424), reflecting continued momentum and strong execution of the Group’s long-term delivery strategy across both the Homebuilding and Partnerships segments – on track to deliver approximately 2,600 Group completions1 for the full year.

- Revenues of €341.6 million, +124% increase on the prior year (H1 2024: €152.2m) and gross profit of €66.8 million (H1 2024: €27.7 million), driven by enhanced Homebuilding delivery volumes and increased Partnerships construction activity.

- Homebuilding completions of 566 units (H1 2024: 294); gross margin increased by 170bps to 21.4% (H1 2024: 19.7%), driven by a favourable site mix, scale and ongoing returns from innovation and standardisation.

- Partnerships continue to grow at scale with the completion of 339 equivalent units1 in the period (H1 2024: 130) and construction activity underway on six sites comprising over 3,900 units.

- Partnerships gross profit of €20.0 million represents the segment’s first material contribution at the interim stage; gross margin was 16.2% (H1 2024: 15.2%), slightly ahead of target owing to the timing of land sales and a favourable tenure mix.

- The Group’s closed and forward order book stands at approximately €1.4 billion (H1 2024: €1.4 billion), providing strong visibility on deliveries for the remainder of FY 2025 and into early FY 2026.

- Land sales of more than €60 million either closed or in advanced stages of contract, reflecting the Group's decision to further optimise capital employed in land and focus on sites of scale.

- Planning permission secured for more than 1,500 units in H1 with all units for FY26 now with planning permissions granted. In addition, all units for FY27 are now planned or have active planning applications, supporting future growth and delivery.

- Material improvement in operating cash flow in H1 2025 (-€10.7 million) versus the prior period (-€194.2 million), reflecting increased completions, greater contribution of the Partnerships segment and working capital optimisation.

- Net debt of €229.9 million at H1 2025 was lower than H1 2024 (€244.1 million) despite higher production levels, reflecting prudent cash management and disciplined capital deployment.

- The Group’s share buyback programme was expanded to €85 million in May 2025, of which approximately €83 million has been returned to shareholders at 23 September. In line with our capital allocation priorities and supported by strong operational performance, cash flow generation, and visibility on land sales, the current buyback programme is being further expanded to €105m. Since 2021 the Group has returned approximately €400 million to shareholders through a series of buybacks, resulting in an approximately 39% reduction in shares outstanding.

Outlook

- ·Full year EPS guidance of 19.5 cent reiterated.

- Continued confidence in delivering approximately 1,500 Homebuilding units, approximately €400 million in Partnerships revenue, and total equivalent1 home deliveries of approximately 2,600 units.

- Intensive focus on capital efficiency to continue with the Group on track to complete €100m of land sales across 2025 and 2026, aligned with optimising the Group’s land portfolio.

- A maturing pipeline of Partnership opportunities is expected to continue to support more than €400 million in revenues over the medium term.

- Revised National Planning Framework expected to have a material, positive impact on the Group’s strategic landbank, resulting in a lower capital deployment requirement in land in future periods.

- Landbank continues to support 2,600-3,600 equivalent1 units per annum through to 2030, underpinning the Group’s medium-term delivery objectives.

CEO Stephen Garvey commented:

“The first half of this year marks another period of successful execution against Glenveagh’s long-term strategy with a focus on scaling delivery, deepening public-private partnerships, and enhancing operational efficiency through innovation. These strategic pillars continue to deliver the strong performance we expect – with revenue, profitability and margin all in line with guidance – while maintaining discipline in capital deployment and risk management across the business.

Our vertically integrated model, landbank optimisation strategy and proven ability to deliver high-quality affordablehomes at scale continue to differentiate Glenveagh in the Irish market.

This is the first interim reporting period where our Partnerships segment has made a material contribution to Group profit, reflecting the scale and momentum now embedded in that part of the business. We are an established partner of choice for the State and continue to see strong demand and a growing pipeline of opportunities.

The benefits of our early investment in innovation and standardisation are also now visible in the enhanced margin profile. The advantages of our modern methods of construction are being felt across the two business segments. Our ongoing investment in next-generation building approaches enables us to deliver greater affordability for customers and supports greater value creation for shareholders.

We’ve remained disciplined in how we manage capital. Despite higher production levels, net debt is lower year-on-year, and we’ve continued to create additional value for shareholders via our buyback programme, a feature we expect to maintain.

In July, we welcomed the publication of the National Development Plan and the renewed focus on infrastructure and planning reform. These are critical enablers of housing delivery. A policy environment that supports viability, accelerates delivery and attracts private capital will be essential to meeting Ireland’s housing needs.In parallel, positive policy developments – including updates to rent regulation and apartment standards – further strengthen the prospects for increasing housing output in Ireland.

Against this backdrop, we are uniquely positioned, with strong visibility on future delivery both for the balance of this year and future years, and we remain confident in our ability to deliver sustainable value creation.”